The Global Polycarbonate market is forecast to reach USD 30 Billion by 2032, registering a CAGR of 6% between 2023 and 2032.

Global Polycarbonate Market Overview

Polycarbonate is a versatility and durable thermoplastic that has gained significant traction in various end-use industries worldwide. It is a durable and transparent plastic that features an impressive combination of strength, toughness, rigidity, and impact resistance. The important properties of polycarbonate materials enable them to be used in a wide range of applications, including optical media, electronic & consumer appliances, automotive, construction, sports & safety gears, and medical devices.

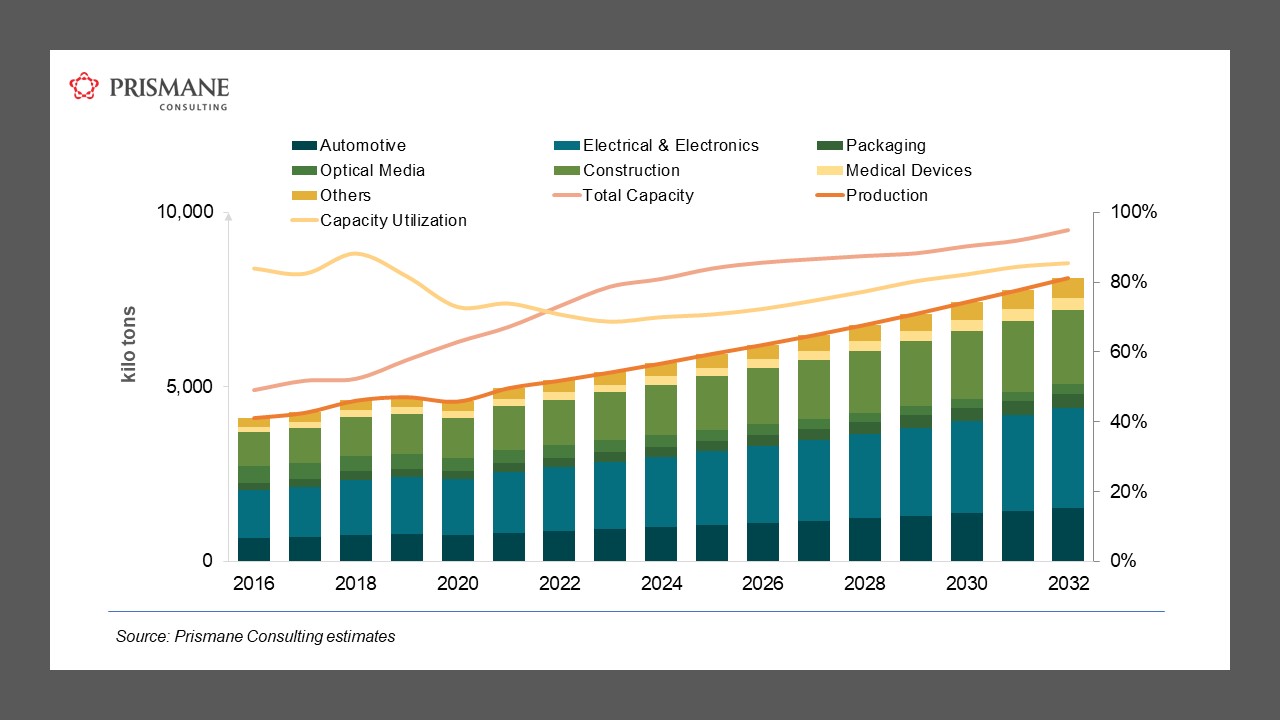

The global polycarbonate market has experienced steady growth over the years, driven by its wide range of applications. Polycarbonate s high impact resistance, optical clarity, and excellent thermal properties make it ideal for numerous products, from eyewear lenses to car headlights. Global polycarbonate demand was estimated to be over 5,000 kilo tons in 2022 which is projected to grow at a CAGR of 4% between 2023 and 2032. Asia-Pacific is the largest region in terms of production and polycarbonate consumption. China is leading the global polycarbonate demand with around 2500 kilo tons in 2022. Large Automotive industry and dominating electronics and electrical manufacturing base in China is pushing the demand for polycarbonate consumption at more than 5% in the country.

Growing purchasing power in the developing economies is seen as a key driver of demand for Polycarbonate resins. Economies in the Asia-Pacific have been thriving on account of the advancements witnessed in automotive and electronics manufacturing. The sectors account for a significant share of exports of countries like Japan, China, South Korea, and India. There are new opportunities for polycarbonate compounds growth in automotives where broader penetration in the automotive segment is expected due to changing specifications and new electric and hybrid applications are coming forward as the sub end use sectors of automobiles with the fastest growth.

Polycarbonate Market in China

China plays a pivotal role in the global polycarbonate market. As one of the world s largest consumers and producers of polycarbonate, China s market dynamics significantly impact the industry. The country accounts for a major share of global polycarbonate production capacities. Taiwan is also important producer of Polycarbonate with Formosa Chemicals & Fibre Corp., Chimei Corporation and Chilin Technology Co., Ltd. as the major players in the country. Taiwan majorly exports its polycarbonate produce to China and other countries. The polycarbonate market has witnessed many changes in recent years. Recently, China declared its intention to impose anti-dumping tariffs on imports of polycarbonate (PC) originating from Taiwan. Commencing on Tuesday (August 15), China applied provisional anti-dumping duties, with rates reaching as high as 22.4%. Notably, Taiwanese producers will face the following duty rates: 16.9% for Formosa Chemicals & Fibre Corp., 17% for Chimei Corporation, and 22.4% for other Taiwanese firms, as communicated by the Ministry of Commerce of the People s Republic of China.

Polycarbonate Price Trend

Polycarbonate prices can be volatile, influenced by factors such as raw material costs, supply chain disruptions, and market demand. It is crucial for businesses to stay updated on price trends to maintain profitability. General-purpose polycarbonate resin prices were at approximately USD 2,822 per ton before the onset of the COVID-19 pandemic in 2020. However, the global economic slowdown, resulting from nationwide lockdowns, had a significant impact on several industries that use polycarbonate resins. This led to a decline in the prices of general-purpose polycarbonate resin, which dropped to around USD 2,290 per ton in 2021. During 2021, there was a notable surge in both the demand and supply of polycarbonate resins, causing prices to reach USD 3,300 per ton before subsequently decreasing to approximately USD 3,000 per ton. This drop was primarily due to the slowdown in China, attributed to the country s strict zero-COVID policy. Prismane Consulting forecasts a further decrease in polycarbonate prices in 2023. This decrease is anticipated due to improving capacity utilization rates and polycarbonate production capacities in China, and the closure of polycarbonate resin facilities in Europe. We expect polycarbonate prices to range from USD 2,300 to USD 2,500 per ton in 2023.

Growing Segments: Polycarbonate Sheets, Panels, and Films

Polycarbonate sheets find extensive use in the construction and automotive industries due to their high impact resistance and transparency. These sheets are in high demand for applications like roofing, skylights, and greenhouse structures. Similarly, Polycarbonate panels have gained popularity in architectural design, offering a blend of aesthetics and functionality. They are used in building facades, partitions, and interior design elements. Polycarbonate films are essential components in various industries, including electronics and packaging. Their durability, heat resistance, and optical clarity make them a preferred choice for applications like touchscreens and labels.

Polycarbonate Market Trends and Future Prospects

The polycarbonate industry is long. With an increasing focus on sustainability, manufacturers are developing eco-friendly polycarbonate alternatives. For instance, LG Chemicals has set up a pilot plant to produce 1000 tons of polycarbonate resins by Carbon Capture, in South Korea. The company plans to verify carbon mitigation values and catalyst performance with the intent to expand scope by 2026. Additionally, advancements in technology are driving innovation in polycarbonate applications, including medical devices and automotive glazing. Polycarbonate is gaining traction in the automotive sector, where lightweight materials are crucial for fuel efficiency. It is used for exterior components like bumpers and headlamp lenses, reducing vehicle weight without compromising safety. Polycarbonate glazing is making waves in the automotive and construction industries offering superior impact resistance and thermal insulation, making it an excellent choice for windows and windshields.

To know more about Polycarbonate Resins Market or any other Engineering Plastic s Market, visit www.prismaneconsulting.com or write to us at sales@prismaneconsulting.com

Mr. Tejas Shah

Prismane Consulting Private Limited

420, Amanora Chambers,

Town Centre Amanora,

Magarpatta Road, Hadapsar,

Pune, India 411028

Visit

and follow us on our social media:

LinkedIn

Twitter

Facebook

YouTube

About Prismane Consulting

Prismane Consulting is a unique global boutique consulting firm with an Indian origin. We present ourselves to the world outside providing management, economic and technical expertise to improve customer engagement, boost operational efficiency, reduce costs and achieve superior business results. Prismane Consulting serves leading businesses in the field of Chemicals, Petrochemicals, Polymers, Materials, Environment and Energy. We have been advising clients on their key strategic issues solving their toughest and most critical business problems.

For update on the annual subscription (monthly, quarterly, and annually) on the chemicals industry, please write to sales@prismaneconsulting.com